If you’re aiming to break into fintech recruitment in the Philippines, this blog is for you. Whether you’re a fresh graduate, a career shifter, or simply exploring fintech roles, understanding how recruitment works and how to stand out can make all the difference. In this post, you’ll find practical tips grounded in local market insights, along with resources from credible platforms such as LinkedIn and Forbes. Use these strategies to refine your applications, strengthen your approach, and secure your first opportunity in the fintech industry

1. Understand What Fintech Companies Look For

Before you apply, know what skills, traits, and experience fintech firms seek. Because fintech sits at the intersection of finance, technology, and regulation, the expectations are different from purely tech or pure finance firms.

Key attributes include:

- Technical foundations: basic programming (Python, SQL), understanding of APIs, data analytics, sometimes blockchain or machine learning.

- Regulatory / compliance awareness: AML, KYC/eKYC, risk, data privacy (especially under BSP/SEC/other local regulatory bodies in PH).

- Soft skills & adaptability: problem solving, working under ambiguity, cross-functional collaboration.

- Digital / product mindset: user centricity, lean product development, iterative ways of working.

For example, Forbes notes that to succeed in fintech, adaptability is one of the top traits employers look for.

2. Map out the Recruitment Process in Fintech

Knowing how the process typically works helps you prepare, reduce anxiety, and avoid surprises.

According to A7 Recruitment’s guide, here are the common stages in fintech recruitment in the Philippines:

| Stage | What Happens | What You Should Do |

| Application | You submit your CV/resume & LinkedIn (or other profiles). Might include cover letter or portfolio. | Tailor your resume for fintech-relevant roles. Highlight tech & finance projects. Keep LinkedIn profile clean and up-to-date. |

| Initial Screening | Recruiters assess technical skills, fintech-domain knowledge, and cultural fit. | Research the company; prepare to explain why fintech interests you. Be ready with examples. |

| Technical / Skills Assessment | Tests, case studies, coding exercises (if applicable) or exercises related to fintech tasks. | Practice with online coding challenges; build small fintech-type projects; review industry regulations and frameworks. |

| Behavioral / Fit Interviews | How you problem-solve, contributions, how you handle ambiguous situations & teamwork. | Use the STAR method; prepare stories where you solved problems, dealt with deadlines, learned quickly. |

| Final / Offer Stage | Senior interviews, negotiation, offer. Might include meeting CTO, Head of Product, or compliance lead. | Be clear about your expectations; research salary benchmarks in fintech; ask about growth and learning opportunities. |

On average, the fintech recruitment process in the PH takes 4-6 weeks, though highly specialized roles (e.g. blockchain engineer, compliance specialist) may take longer.A7 Recruitment

3. Build Skills & Credentials That Make You Stand Out

To land your first role, you’ll often need to show more than just “having a degree.” Here are ways to build credibility and signals to employers that you can do the job.

- Upskill in tech & finance basics: Even if your role isn’t deeply technical, having a foundation in data literacy, financial product knowledge, or understanding digital payments platforms gives you an edge. The Philippine IT-BPM industry is pushing for growth especially in areas like cybersecurity, data analytics, and AI to fill critical talent gaps

- Certifications or short courses: For example, data analytics, cybersecurity fundamentals, compliance or AML certifications. Being current with regulatory frameworks like BSP data privacy and AML is a plus.

- Projects / portfolio: Build something real – a small fintech app, a data analysis project related to finance, or even case studies of real business problems. It helps especially if you have little formal experience.

- Internships, entry-level roles, or volunteering: These still count. They help you gain exposure, make connections, and can be stepping stones.

4. Use Fintech Recruitment Agencies & Networks

This is where A7 Recruitment and similar fintech recruitment agency or fintech recruiting firms come into play.

Why use a fintech recruitment agency Philippines / fintech recruiting agency?

- They understand the jargon, roles, skills, and expectations in fintech. A7 Recruitment, for example, specializes in fintech recruitment solutions and tailors their services to both candidates and companies.

- They often have “hidden” roles – opportunities not posted publicly.

- They can give you feedback on your resume, help you prepare for fintech-specific interviews, advise on salary & benefit expectations.

They have market insights: what roles are growing, where the gaps are, how regulations are shifting which helps you position yourself well.

How to leverage agencies & networks:

- Register with a fintech recruitment agency. Fill out their candidate profile fully; show your willingness to learn roles adjacent to what you want (e.g. support roles, junior analyst).

- Attend fintech meetups, webinars, conferences. Join FinTech Alliance PH, follow fintech news.

- Update and engage on LinkedIn: share insights, comment on fintech developments, connect with fintech professionals.

5. Prepare Application Materials & Interview Skills Specifically for Fintech

Applying generally won’t be enough. Make sure everything you put out shows fintech alignment.

- Resume & LinkedIn: Emphasize fintech-relevant keywords (payments, compliance, APIs, risk, data, etc.). Quantify achievements if possible. If you built something, include it.

- Portfolio or sample work: Side projects, Github, case studies. Even if non-technical, maybe you analysed financial data, wrote about fintech trends, or improved process/digital workflow somewhere.

- Mock interviews / preparation: Especially for behavioral questions (“tell me a time you…”) and role plays. Practice frameworks. Prepare for technical assessments if applicable.

Know the industry: Be ready to discuss current fintech trends in PH (digital payments growth, regulatory changes, embedded finance, regtech), know key players, regulatory bodies (BSP, SEC), and emerging risks (cybersecurity, fraud).

6. Mindset & Long-Term Approach

Fintech is competitive and constantly evolving. A few mindset shifts help:

- Be patient. First role may be junior or not perfect. Getting foot in door matters.

- Keep learning. New technologies, new regulations, new ways of working. Being curious is a strength.

- Be flexible in roles / responsibilities. Sometimes first roles are hybrids or support-adjacent; they build experience.

Seek feedback aggressively. From interview rejections, from agency interactions, from peers. Use it to improve.

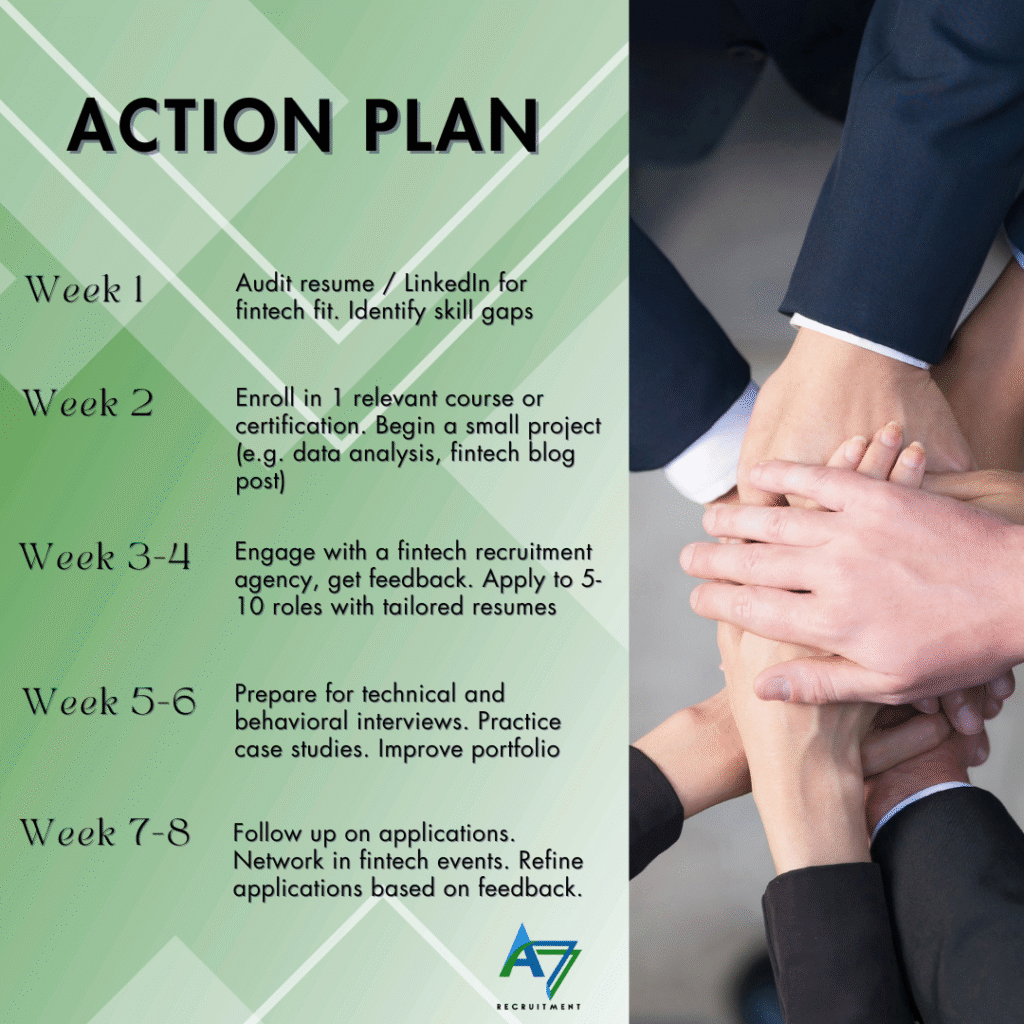

7. Example Action Plan You Can Follow

Here’s a sample week-by-week action plan for someone who wants their first fintech role in 2-3 months timeframe.

Research / Market Insights (Philippines)

These are data points & findings you can reference / cite to back up your advice:

- A7 Recruitment says fintech in PH is growing fast, driven by mobile-first users, government support (e.g. National Strategy for Financial Inclusion, Digital Payments Transformation Roadmap).

- The number of fintech firms in Philippines rose to over 300 in 2023, especially in payments, lending, personal finance apps. A7 Recruitment

- Average timeline for fintech recruitment in PH tends to be 4-6 weeks for most roles

LinkedIn & JobStreet insights indicate that skills mismatch is a common barrier; many candidates lack specific fintech or compliance/regulatory skills. (From A7 Recruiting Agency secrets article)

Summary of Key points

- Fintech recruitment requires a blend of technical, financial, regulatory, and soft skills.

- Knowing the hiring process helps you prepare: application → screening → assessments → interviews → offers.

- Building skills, doing projects, gaining relevant exposure and using fintech recruitment agencies / top fintech recruiters gives you an edge.

Mindset matters: continuous learning, flexibility, seeking feedback.