Breaking into the fintech industry can be exciting yet overwhelming, especially when you are unsure about what to expect from the hiring process. Whether you are a fresh graduate or an experienced professional looking to pivot, understanding the flow of fintech recruitment can give you a valuable edge. In the Philippines, fintech recruitment has expanded rapidly as digital finance adoption continues to rise, with companies actively searching for tech-savvy, adaptable candidates.

We’ll walk you through what the typical hiring journey looks like, highlight what recruiters are looking for, and share practical steps to position yourself for success.

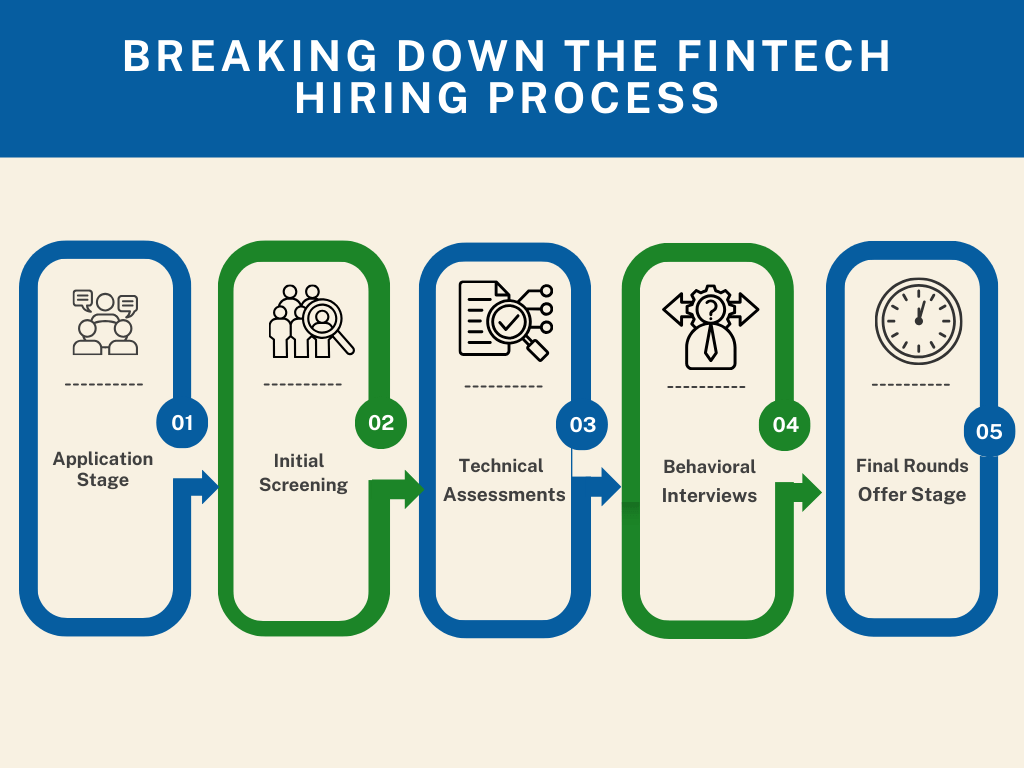

The Step-by-Step Breakdown of the Fintech Hiring Process

1. Application Stage – First Impressions Count

Candidates usually apply through online job portals, company websites, or with the help of a fintech recruitment agency in the Philippines. At this stage, your resume and LinkedIn profile are crucial. Research by LinkedIn Talent Solutions shows that 72 percent of recruiters check an applicant’s online presence before shortlisting them (LinkedIn Talent Solutions).

Applicant tip:

- Tailor your CV to highlight fintech-relevant experience (digital banking, cybersecurity, blockchain, or financial data analysis).

Keep your LinkedIn active by engaging with fintech-related content.

2. Initial Screening – Recruiter’s Evaluation

This stage usually involves:

- Checking your technical skills (Python, SQL, API integration, blockchain).

- Evaluating fintech knowledge (compliance, digital payments, cybersecurity).

- Assessing cultural fit.

Working with a fintech recruitment agency gives you an edge, as recruiters can fine-tune your application and coach you before your resume lands on a hiring manager’s desk.

3. Technical Assessments – Showcasing Your Skills

Here, employers test what you can actually do. Assessments often include:

- Coding challenges (for developers, engineers, or IT roles).

- Data exercises (for analytics, risk, or fraud detection positions).

- Case studies simulating digital payment or compliance issues.

Applicant tip:

Practice coding tests on platforms like HackerRank and LeetCode, and stay updated on fintech regulations such as AMLA (Anti-Money Laundering Act) and BSP guidelines.

4. Behavioral Interviews – Testing Problem-Solving and Culture Fit

Beyond technical expertise, fintech employers want adaptable problem-solvers. Interviewers often ask about:

- Managing tight deadlines.

- Working with cross-functional teams.

- Navigating ambiguous problems.

Applicant tip:

Use the STAR method (Situation, Task, Action, Result) when answering. This shows structure and clarity in your thought process.

5. Final Rounds and Offer Stage – Sealing the Deal

In the final stage, candidates may meet with department heads or senior executives. This is where companies determine if you align with their long-term goals.

The good news? Fintech employers move fast when they find the right fit. Negotiations are common, so having a fintech recruiting agency guide you through packages and expectations ensures you secure a competitive offer.

Timelines: How Long Does Fintech Recruitment Take?

Many applicants wonder how long the process takes. On average in the Philippines:

- Application to initial screening: 1–2 weeks

- Technical assessments: 1 week

- Behavioral interviews: 1–2 weeks

- Final rounds and offer: 2–3 weeks

Overall, fintech recruitment may take 4–6 weeks, though highly specialized roles (like blockchain engineers or compliance experts) can take longer.

How Candidates Can Stand Out in Fintech Recruitment

Here are practical ways to strengthen your chances:

1. Upskill continuously

- Take certifications in data analytics, cybersecurity, blockchain, or AI in finance.

- Join fintech bootcamps or short courses offered by local universities.

2. Leverage the best fintech recruiters

- Recruiters provide insider knowledge about what employers are truly looking for.

- They can position you for roles not advertised on public platforms.

3. Build your professional brand

- Keep LinkedIn active with fintech insights.

- Network at fintech events or webinars in the Philippines.

4. Create a portfolio

- Showcase projects (apps, case studies, or fintech research). Employers love seeing real-world application of skills.

5. Stay informed on industry trends

- Follow Jobstreet and PhilJobNet for role demand.

- Track emerging niches like regtech (regulatory technology) and embedded finance.

Guide to Resolution: How A7 Recruitment Helps Candidates

The fintech hiring process may feel complex, but you don’t have to navigate it alone. A7 Recruitment bridges job seekers with leading fintech employers in the Philippines. Here’s how we help:

- Personalized career matching – We match your skills to roles with high-growth potential.

- Market insights – Our team shares updates on salary benchmarks, employer expectations, and fintech industry shifts.

- Application coaching – From refining resumes to practicing interviews, we guide you in presenting your best self.

- Employer connections – Our relationships with top fintech firms open doors to exclusive opportunities.

Career trajectory planning – We go beyond matching; we help you map your long-term career growth in fintech.

Ready for the next step?

The fintech recruitment process can feel intimidating, but by breaking it into stages application, screening, assessments, interviews, and offers you can approach it with confidence. Employers are looking for professionals who combine technical expertise with adaptability and a forward-thinking mindset.

By continuously upskilling, building your brand, and leveraging the right networks, you’ll stand out in this competitive field. And with a trusted recruitment solution agency like A7 Recruitment by your side, you’ll not only land a job you’ll find a career path in fintech where you can thrive.

If you’re ready to take the next step in your fintech journey, connect with us today and explore opportunities that match your skills and ambitions.