The race for top talent in financial technology is fiercer than ever. In 2025, fintech recruitment in the Philippines is being reshaped by digital transformation, new regulations, and changing workforce expectations. For employers, attracting and keeping skilled professionals now demands a sharper strategy.

With startups and global firms competing for a limited pool of experts who can bridge finance and tech, hiring has become a major challenge. Partnering with a fintech recruitment agency gives businesses the edge to adapt, hire effectively, and drive growth.

This guide highlights the current talent landscape, the challenges employers face, and how the right recruitment partner can help you succeed.

Why Fintech Recruitment Is Crucial in 2025

The fintech industry in the Philippines is growing rapidly. A recent report from the Bangko Sentral ng Pilipinas (BSP) highlighted that digital payments accounted for 42 percent of retail transactions in 2022, with projections that this figure will surpass 50 percent by 2025 (BusinessMirror).

This digital surge has increased the demand for professionals skilled in areas like:

- Digital banking platforms

- Blockchain development

- Cybersecurity and compliance

- Artificial intelligence in financial services

- Data analytics and fraud detection

However, supply is not keeping up. According to DOLE, skill shortages in IT-related industries remain a pressing issue in the Philippines (DOLE). This means employers face fierce competition for qualified candidates. Without a strong recruitment strategy, many risk losing talent to competitors or foreign opportunities.

The Top Recruitment Challenges Employers Face

1. Talent Shortage in Critical Roles

Fintech companies need candidates who can merge technical expertise with financial knowledge. Roles such as compliance officers with tech backgrounds or blockchain developers are especially hard to fill.

2. Global Competition

Remote work has widened the talent pool, but it has also intensified competition. Filipino fintech professionals are being recruited by international companies offering higher pay and remote flexibility.

3. Evolving Candidate Expectations

According to a LinkedIn Talent Solutions report, professionals now value flexibility, career development, and company culture as much as salary (LinkedIn Talent Solutions). Employers who fail to adapt risk losing top candidates.

4. Retention Risks

Even after hiring, retaining fintech talent is a challenge. High turnover rates can cost companies up to twice the employee’s annual salary, not to mention delays in product rollouts or compliance projects.

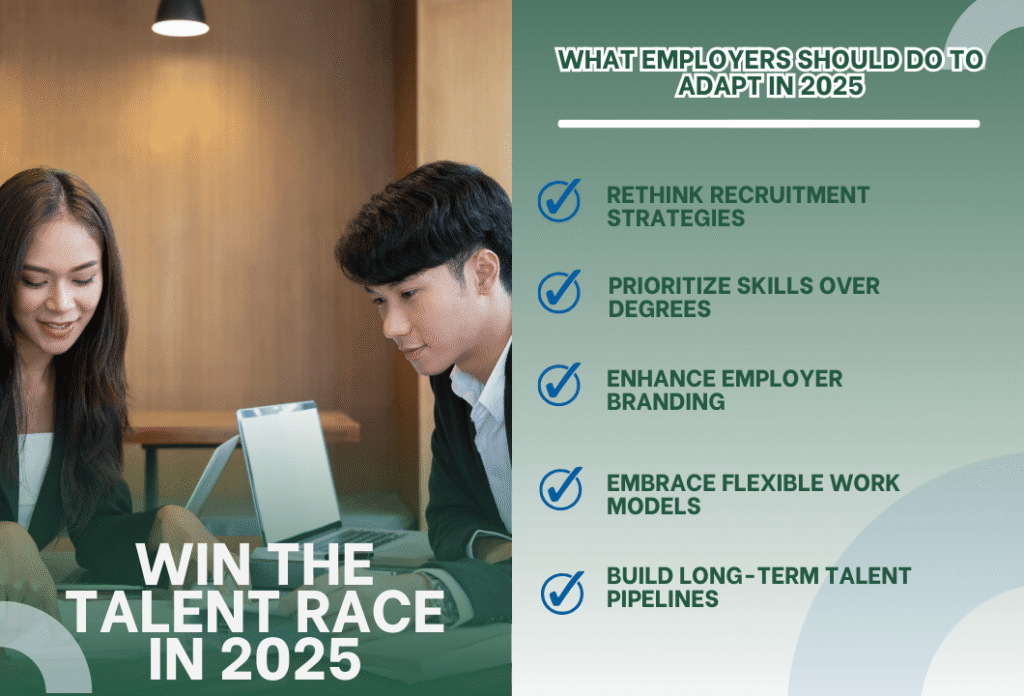

What Employers Should Do to Adapt in 2025

1. Rethink Recruitment Strategies

Traditional hiring methods no longer suffice. Employers must partner with specialized fintech recruitment agencies that understand the local and global talent landscape.

2. Prioritize Skills Over Degrees

As Deloitte has noted, skills-based hiring is becoming the norm in digital-first industries. Employers should focus on demonstrated ability in coding, compliance, or fintech product development, rather than only on formal qualifications.

3. Enhance Employer Branding

Top candidates want to work with innovative companies. Employers need to highlight their digital culture, professional growth opportunities, and commitment to innovation.

4. Embrace Flexible Work Models

Hybrid and remote setups remain highly attractive. Offering these options widens the talent pool and strengthens retention.

5. Build Long-Term Talent Pipelines

Instead of scrambling to hire reactively, employers should develop ongoing pipelines with the help of the best fintech recruiters, ensuring consistent access to top professionals.

The Role of Fintech Recruitment Agencies in the Philippines

Partnering with a fintech recruiting agency can help employers overcome hiring roadblocks. These agencies offer:

- Access to niche talent pools -Beyond job boards, recruiters maintain networks of passive candidates not actively applying elsewhere.

- Market intelligence – Agencies provide insights into salary trends, demand for roles, and candidate expectations.

- Speed and efficiency – Specialized recruiters shorten the hiring process, reducing costly delays in projects.

- Tailored fintech recruitment solutions – Matching not just skills, but also culture fit, ensuring long-term retention.

For example, A7 Recruitment connects employers with skilled fintech professionals while also providing strategic insights to adapt to a competitive hiring environment.

Guide to Resolution: How Employers Can Win Top Talent

Here’s a step-by-step pathway to alleviating fintech recruitment challenges in 2025:

1. Audit your current hiring practices

- Identify where bottlenecks occur (long response times, weak sourcing channels, lack of market awareness).ness).

2. Partner with a fintech recruitment agency in the Philippines

- A7 Recruitment offers tailored solutions, from sourcing to onboarding support.

3. Leverage data-driven insights

- Use salary benchmarks, turnover analysis, and industry reports to create competitive offers.

4. Develop strong onboarding and retention programs

- Go beyond hiring ensure employees are integrated smoothly and offered career development opportunities.

5. Invest in future skills

- Work with a fintech recruitment agency to identify which roles will be most in demand in the next 2–3 years and start building your pipeline now.

By taking these steps, employers can bridge the talent gap, strengthen their workforce, and stay ahead in a sector that rewards adaptability.

Conclusion

In 2025, the fintech talent race in the Philippines is at full speed. Companies that fail to adapt their hiring strategies risk falling behind. The good news is that by rethinking recruitment, prioritizing skills, and partnering with a trusted recruitment solution agency like A7 Recruitment, employers can secure the professionals they need to innovate and grow.

The key is not just filling vacancies, but building long-term talent pipelines that align with your company’s vision. If your organization is ready to win top fintech talent this year, A7 Recruitment is here to bridge the gap and connect you with the right solutions.

👉 Learn more about their Fintech specialization here: A7 Recruitment Fintech Recruitment